eodhd is a private company that offers APIs to a set of comprehensive and high quality financial data for over 70+ exchanges across the world. This includes:

Package eodhdR2 is the second and backwards incompatible version of eodhd, allowing fast and intelligent access to most of the API’s endpoints.

# available in CRAN

install.package("eodhdR2")

# development version

devtools::install_github("EodHistoricalData/R-Library-for-financial-data-2024")After registering in the eodhd website and choosing a subscription, all users will authenticate an R session using a token from the website. For that:

While using eodhdR2, all authentications are managed

with function eodhdR2::set_token():

eodhdR2::set_token("YOUR_TOKEN")Alternatively, while testing the API, you can use the “demo” token for demonstration.

token <- eodhdR2::get_demo_token()

eodhdR2::set_token(token)

#> ✔ eodhd API token set

#> ℹ Account name: API Documentation 2 (supportlevel1@eodhistoricaldata.com)

#> ℹ Quota: 63463 | 10000000

#> ℹ Subscription: demo

#> ✖ You are using a **DEMONSTRATION** token for testing pourposes, with

#> limited access to the data repositories. See <https://eodhd.com/>

#> for registration and, after finding your token, use it with

#> function eodhdR2::set_token("TOKEN").ticker <- "AAPL"

exchange <- "US"

df_prices <- eodhdR2::get_prices(ticker, exchange)

#>

#> ── retrieving price data for ticker AAPL|US ────────────────────────────────────

#> ! Quota status: 63463|10000000, refreshing in 5.8 hours

#> ℹ cache file AAPL_US_eodhd_prices.rds saved

#> ✔ got 11021 rows of prices

#> ℹ got daily data from 1980-12-12 to 2024-08-30

head(df_prices)

#> date open high low close adjusted_close volume ticker

#> 1 1980-12-12 28.7392 28.8736 28.7392 28.7392 0.0989 469033600 AAPL

#> 2 1980-12-15 27.3728 27.3728 27.2608 27.2608 0.0938 175884800 AAPL

#> 3 1980-12-16 25.3792 25.3792 25.2448 25.2448 0.0869 105728000 AAPL

#> 4 1980-12-17 25.8720 26.0064 25.8720 25.8720 0.0891 86441600 AAPL

#> 5 1980-12-18 26.6336 26.7456 26.6336 26.6336 0.0917 73449600 AAPL

#> 6 1980-12-19 28.2464 28.3808 28.2464 28.2464 0.0972 48630400 AAPL

#> exchange ret_adj_close

#> 1 US NA

#> 2 US -0.05156724

#> 3 US -0.07356077

#> 4 US 0.02531646

#> 5 US 0.02918070

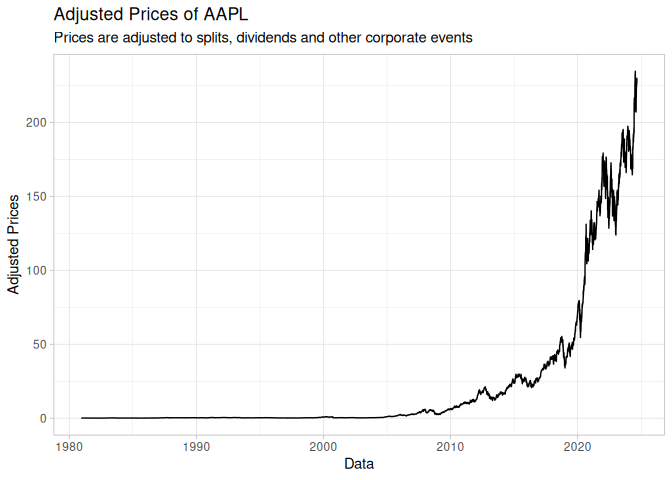

#> 6 US 0.05997819library(ggplot2)

p <- ggplot(df_prices, aes(y = adjusted_close, x = date)) +

geom_line() +

theme_light() +

labs(title = "Adjusted Prices of AAPL",

subtitle = "Prices are adjusted to splits, dividends and other corporate events",

x = "Data",

y = "Adjusted Prices")

p

ticker <- "AAPL"

exchange <- "US"

df_div <- eodhdR2::get_dividends(ticker, exchange)

#>

#> ── retrieving dividends for ticker AAPL|US ─────────────────────────────────────

#> ! Quota status: 63467|10000000, refreshing in 5.8 hours

#> ℹ cache file AAPL_US_eodhd_dividends.rds saved

#> ✔ got 84 rows of dividend data

head(df_div)

#> date ticker exchange declarationDate recordDate paymentDate period

#> 1 1987-05-11 AAPL US <NA> <NA> <NA> <NA>

#> 2 1987-08-10 AAPL US <NA> <NA> <NA> <NA>

#> 3 1987-11-17 AAPL US <NA> <NA> <NA> <NA>

#> 4 1988-02-12 AAPL US <NA> <NA> <NA> <NA>

#> 5 1988-05-16 AAPL US <NA> <NA> <NA> <NA>

#> 6 1988-08-15 AAPL US <NA> <NA> <NA> <NA>

#> value unadjustedValue currency

#> 1 0.00054 0.12096 USD

#> 2 0.00054 0.06048 USD

#> 3 0.00071 0.07952 USD

#> 4 0.00071 0.07952 USD

#> 5 0.00071 0.07952 USD

#> 6 0.00071 0.07952 USDlibrary(ggplot2)

p <- ggplot(df_div, aes(y = value, x = date)) +

geom_point(size = 1) +

theme_light() +

labs(title = "Adjusted Dividends of AAPL",

x = "Data",

y = "Adjusted Dividends")

p

ticker <- "AAPL"

exchange <- "US"

l_fun <- eodhdR2::get_fundamentals(ticker, exchange)

#>

#> ── retrieving fundamentals for ticker AAPL|US ──────────────────────────────────

#> ! Quota status: 63469|10000000, refreshing in 5.8 hours

#> ✔ querying API

#> ✔ got 13 elements in raw list

names(l_fun)

#> [1] "General" "Highlights" "Valuation"

#> [4] "SharesStats" "Technicals" "SplitsDividends"

#> [7] "AnalystRatings" "Holders" "InsiderTransactions"

#> [10] "ESGScores" "outstandingShares" "Earnings"

#> [13] "Financials"wide_financials <- eodhdR2::parse_financials(l_fun, "wide")

#>

#> ── Parsing financial data for Apple Inc | AAPL ──

#>

#> ℹ parsing Balance_Sheet data

#> ℹ quarterly

#> ℹ yearly

#> ℹ parsing Cash_Flow data

#> ℹ quarterly

#> ℹ yearly

#> ℹ parsing Income_Statement data

#> ℹ quarterly

#> ℹ yearly

#> ✔ got 564 rows of financial data (wide format)

head(wide_financials)

#> # A tibble: 6 × 127

#> date filing_date ticker company_name frequency type_financial

#> <date> <date> <chr> <chr> <chr> <chr>

#> 1 2024-06-30 2024-08-02 AAPL Apple Inc quarterly Balance_Sheet

#> 2 2024-03-31 2024-05-03 AAPL Apple Inc quarterly Balance_Sheet

#> 3 2023-12-31 2024-02-02 AAPL Apple Inc quarterly Balance_Sheet

#> 4 2023-09-30 2023-11-03 AAPL Apple Inc quarterly Balance_Sheet

#> 5 2023-06-30 2023-08-04 AAPL Apple Inc quarterly Balance_Sheet

#> 6 2023-03-31 2023-05-05 AAPL Apple Inc quarterly Balance_Sheet

#> # ℹ 121 more variables: currency_symbol <chr>, totalAssets <dbl>,

#> # intangibleAssets <dbl>, earningAssets <dbl>, otherCurrentAssets <dbl>,

#> # totalLiab <dbl>, totalStockholderEquity <dbl>, deferredLongTermLiab <dbl>,

#> # otherCurrentLiab <dbl>, commonStock <dbl>, capitalStock <dbl>,

#> # retainedEarnings <dbl>, otherLiab <dbl>, goodWill <dbl>, otherAssets <dbl>,

#> # cash <dbl>, cashAndEquivalents <dbl>, totalCurrentLiabilities <dbl>,

#> # currentDeferredRevenue <dbl>, netDebt <dbl>, shortTermDebt <dbl>, …long_financials <- eodhdR2::parse_financials(l_fun, "long")

#>

#> ── Parsing financial data for Apple Inc | AAPL ──

#>

#> ℹ parsing Balance_Sheet data

#> ℹ quarterly

#> ℹ yearly

#> ℹ parsing Cash_Flow data

#> ℹ quarterly

#> ℹ yearly

#> ℹ parsing Income_Statement data

#> ℹ quarterly

#> ℹ yearly

#> ✔ got 67680 rows of financial data (long format)

head(long_financials)

#> # A tibble: 6 × 9

#> date filing_date ticker company_name frequency type_financial

#> <date> <date> <chr> <chr> <chr> <chr>

#> 1 2024-06-30 2024-08-02 AAPL Apple Inc quarterly Balance_Sheet

#> 2 2024-06-30 2024-08-02 AAPL Apple Inc quarterly Balance_Sheet

#> 3 2024-06-30 2024-08-02 AAPL Apple Inc quarterly Balance_Sheet

#> 4 2024-06-30 2024-08-02 AAPL Apple Inc quarterly Balance_Sheet

#> 5 2024-06-30 2024-08-02 AAPL Apple Inc quarterly Balance_Sheet

#> 6 2024-06-30 2024-08-02 AAPL Apple Inc quarterly Balance_Sheet

#> # ℹ 3 more variables: currency_symbol <chr>, name <chr>, value <dbl>